How Much Are Pre-Rolls in the USA 2026

Quick Reference: 2026 Pre-Roll Prices at a Glance

| Price Tier | States | Avg. Price (1g) |

|---|---|---|

| Budget ($4–$8) | OR, WA, MI, CO | $5–$8 |

| Mid-Range ($8–$15) | CA, AZ, NV, MA, ME | $10–$14 |

| Premium ($15–$25+) | IL, NJ, MD, MO, NY | $15–$25 |

Tier 1: Budget-Friendly States ($4–$10 Average)

Oregon

-

-

-

- Average price: $7.50 (lowest in nation for quality)

-

-

-

-

-

- Infused average: $9.05

-

-

-

-

-

- Under $10: 73% of products

-

-

-

-

-

- Market status: Mature (opened 2015)

-

-

-

-

-

- Context: Chronic oversupply keeps prices rock-bottom. High competition among growers.

-

-

-

-

-

- Tip: Portland has the most competitive pricing; rural areas slightly higher.

-

-

Washington

-

-

-

- Average price: $6.19

-

-

-

-

-

- Infused average: $6.34 (lowest in nation)

-

-

-

-

-

- Under $10: 87% of products

-

-

-

-

-

- Market status: Mature (opened 2014)

-

-

-

-

-

- Context: Second-oldest market with efficient supply chain. Even infused products are cheap.

-

-

-

-

-

- Tip: Seattle offers massive selection; compare prices on Leafly before visiting.

-

-

Michigan

-

-

-

- Average price: $6.39

-

-

-

-

-

- Infused average: $10.23

-

-

-

-

-

- Under $10: 88% of products (highest in nation)

-

-

-

-

-

- Market status: Mature (opened 2019)

-

-

-

-

-

- Context: Largest pre-roll market by volume (22+ million units/year). Oversupply drives prices down.

-

-

-

-

-

- Tip: Detroit metro has the most deals; look for $1-$3 pre-rolls during daily specials.

-

-

Colorado

-

-

-

- Average price: $7.98

-

-

-

-

-

- Infused average: $14.88

-

-

-

-

-

- Under $10: 80% of products

-

-

-

-

-

- Market status: Mature (opened 2014)

-

-

-

-

-

- Context: Oldest legal market. Stable pricing with occasional deals.

-

-

-

-

-

- Tip: Tourist areas (ski towns) charge 20-30% more than Denver dispensaries.

-

-

Tier 2: Mid-Range States ($10–$15 Average)

California

-

-

-

- Average price: $14.11

-

-

-

-

-

- Infused average: $19.20

-

-

-

-

-

- Under $10: 51% of products

-

-

-

-

-

- Market status: Developing (opened 2018)

-

-

-

-

-

- Context: Largest market but HIGH taxes (up to 45% total). LA/SF more expensive than Central Valley.

-

-

-

-

-

- Tip: Look for “tax-included” pricing; some dispensaries absorb tax costs.

-

-

Arizona

-

-

-

- Average price: $11.87

-

-

-

-

-

- Infused average: $19.20

-

-

-

-

-

- Under $10: 64% of products

-

-

-

-

-

- Market status: Developing (opened 2021)

-

-

-

-

-

- Context: Smooth medical-to-rec transition created stable supply early.

-

-

-

-

-

- Tip: Phoenix metro has most competition; Tucson slightly cheaper than Scottsdale.

-

-

Nevada

-

-

-

- Average price: $11.92

-

-

-

-

-

- Infused average: $20.50

-

-

-

-

-

- Under $10: 61% of products

-

-

-

-

-

- Market status: Developing (opened 2017)

-

-

-

-

-

- Context: Tourism-driven market. Strip dispensaries charge premium; locals go off-Strip.

-

-

-

-

-

- Tip: Henderson and North Las Vegas offer 15-25% savings vs. Las Vegas Strip.

-

-

Massachusetts

-

-

-

- Average price: $9.83

-

-

-

-

-

- Infused average: $17.38

-

-

-

-

-

- Under $10: 72% of products

-

-

-

-

-

- Market status: Developing (opened 2018)

-

-

-

-

-

- Context: Limited licenses keep supply constrained despite demand.

-

-

-

-

-

- Tip: Western MA (Springfield area) often cheaper than Boston metro.

-

-

Maine

-

-

-

- Average price: $10–$15

-

-

-

-

-

- Infused average: $15–$20

-

-

-

-

-

- Under $10: ~50% of products

-

-

-

-

-

- Market status: Developing (opened 2020)

-

-

-

-

-

- Context: Small population but growing tourism market.

-

-

-

-

-

- Tip: Portland has the best selection and competitive pricing.

-

-

New Mexico

-

-

-

- Average price: $8–$15

-

-

-

-

-

- Infused average: $15–$20

-

-

-

-

-

- Under $10: ~55% of products

-

-

-

-

-

- Market status: Developing (opened 2022)

-

-

-

-

-

- Context: Prices dropping as more cultivators come online.

-

-

-

-

-

- Tip: Albuquerque and Santa Fe have most options; compare menus online.

-

-

Montana

-

-

-

- Average price: $8–$15

-

-

-

-

-

- Infused average: $15–$18

-

-

-

-

-

- Under $10: ~45% of products

-

-

-

-

-

- Market status: Developing (opened 2022)

-

-

-

-

-

- Context: Rural state with limited dispensaries; prices vary significantly by location.

-

-

-

-

-

- Tip: Stock up in larger cities; rural areas have fewer options and higher prices.

-

-

Tier 3: Premium-Priced States ($15–$25+ Average)

Illinois

-

-

-

- Average price: $19.24

-

-

-

-

-

- Infused average: $24.67

-

-

-

-

-

- Under $10: Only 21% of products

-

-

-

-

-

- Market status: Emerging (opened 2020)

-

-

-

-

-

- Context: High taxes + limited licenses = persistent high prices despite 5 years of sales.

-

-

-

-

-

- Tip: Drive to Michigan border towns (30-50% cheaper) if logistics allow.

-

-

Missouri

-

-

-

- Average price: $14.48

-

-

-

-

-

- Infused average: $19.95

-

-

-

-

-

- Under $10: 44% of products

-

-

-

-

-

- Market status: Emerging (opened 2023)

-

-

-

-

-

- Context: New market ramping up quickly. Prices dropping each quarter.

-

-

-

-

-

- Tip: Kansas City and St. Louis have most competition; prices falling fast.

-

-

Maryland

-

-

-

- Average price: $14.84

-

-

-

-

-

- Infused average: $23.13

-

-

-

-

-

- Under $10: Only 27% of products

-

-

-

-

-

- Market status: Emerging (opened 2023)

-

-

-

-

-

- Context: Transition from medical-only still creating supply gaps.

-

-

-

-

-

- Tip: Baltimore has most dispensaries; compare prices across multiple locations.

-

-

New Jersey

-

-

-

- Average price: $15–$25

-

-

-

-

-

- Infused average: $25–$30

-

-

-

-

-

- Under $10: <20% of products

-

-

-

-

-

- Market status: Emerging (opened 2022)

-

-

-

-

-

- Context: Limited retail locations, high demand, proximity to NYC market.

-

-

-

-

-

- Tip: Prices vary wildly by dispensary; always check menus before driving.

-

-

New York

-

-

-

- Average price: $24.81 (highest in nation)

-

-

-

-

-

- Infused average: $30.75 (highest in nation)

-

-

-

-

-

- Under $10: <15% of products

-

-

-

-

-

- Market status: Nascent (opened 2022, still limited)

-

-

-

-

-

- Context: Regulatory delays = very few legal dispensaries. Prices will drop significantly as licenses roll out.

-

-

-

-

-

- Tip: Consider crossing to NJ or MA for significantly lower prices until NY market matures.

-

-

Connecticut

-

-

-

- Average price: $15–$25

-

-

-

-

-

- Infused average: $20–$28

-

-

-

-

-

- Under $10: ~25% of products

-

-

-

-

-

- Market status: Emerging (opened 2023)

-

-

-

-

-

- Context: Small market still developing retail infrastructure.

-

-

-

-

-

- Tip: Check MA dispensaries near the border for better selection and pricing.

-

-

Rhode Island

-

-

-

- Average price: $15–$20

-

-

-

-

-

- Infused average: $20–$25

-

-

-

-

-

- Under $10: ~30% of products

-

-

-

-

-

- Market status: Emerging (opened 2022)

-

-

-

-

-

- Context: Tiny state with limited licenses.

-

-

-

-

-

- Tip: Providence has most options; MA border dispensaries offer alternatives.

-

-

Vermont

-

-

-

- Average price: $10–$20

-

-

-

-

-

- Infused average: $18–$25

-

-

-

-

-

- Under $10: ~40% of products

-

-

-

-

-

- Market status: Emerging (opened 2022)

-

-

-

-

-

- Context: Small, craft-focused market with limited commercial scale.

-

-

-

-

-

- Tip: Burlington area has best selection; rural areas have fewer options.

-

-

Ohio

-

-

-

- Average price: $15–$22

-

-

-

-

-

- Infused average: $20–$28

-

-

-

-

-

- Under $10: ~25% of products

-

-

-

-

-

- Market status: Nascent (opened 2024)

-

-

-

-

-

- Context: Brand new market with limited dispensaries and high demand.

-

-

-

-

-

- Tip: Prices expected to drop significantly within 12-18 months as supply increases.

-

-

Minnesota

-

-

-

- Average price: $18–$25

-

-

-

-

-

- Infused average: $22–$30

-

-

-

-

-

- Under $10: <20% of products

-

-

-

-

-

- Market status: Nascent (opened 2025)

-

-

-

-

-

- Context: Newest market; very limited dispensaries initially.

-

-

-

-

-

- Tip: Early adopters should expect premium pricing; patience will be rewarded.

-

-

Understanding Pre-Roll Price Tiers

Budget Pre-Rolls ($4–$10): What You’re Getting

-

-

-

- Typically 0.5g–1g size

-

-

-

-

-

- House brands or value lines from major producers

-

-

-

-

-

- May use shake, trim, or machine-ground flower

-

-

-

-

-

- Common strains (Blue Dream, OG Kush, Gorilla Glue)

-

-

-

-

-

- Basic packaging (plastic tubes)

-

-

-

-

-

- Best for: Daily users, budget-conscious consumers, trying new dispensaries

-

-

Mid-Range Pre-Rolls ($10–$15): The Sweet Spot

-

-

-

- Typically 1g size

-

-

-

-

-

- Quality flower from known brands

-

-

-

-

-

- Popular or trending strains

-

-

-

-

-

- Consistent quality and burn

-

-

-

-

-

- Decent packaging with strain info

-

-

-

-

-

- Best for: Regular users wanting reliability without premium prices

-

-

Premium & Infused Pre-Rolls ($15–$30+): The Splurge

-

-

-

- Often 1g+ size with concentrates added

-

-

-

-

-

- Infusions: kief, hash, diamonds, live resin, distillate

-

-

-

-

-

- Top-shelf or exotic strains

-

-

-

-

-

- Specialty tips (glass, wood, ceramic)

-

-

-

-

-

- Premium packaging (glass tubes, collectible designs)

-

-

-

-

-

- Best for: Special occasions, high-tolerance users, connoisseurs

-

-

How to Get Premium Quality Without Premium Prices

Living in a high-tax state doesn’t mean settling for a subpar experience—or breaking the bank every time you light up.

While consumers in Illinois, New Jersey, and New York face some of the steepest pre-roll prices nationwide, smart shoppers are discovering that accessories can bridge the gap between budget buys and premium enjoyment.

A pre-roll flavor booster device is one such solution gaining popularity. These specialized tips attach to any standard pre-roll and work by enhancing airflow while adding subtle flavor profiles to each draw. The result? That $8 house brand suddenly delivers a smoother, more flavorful experience comparable to products twice its price.

What makes flavor booster tips worth considering:

- – Turn budget pre-rolls into a premium-feeling session

- – Reusable design means long-term savings

- – Compatible with pre-rolls from any dispensary

- – Cooler, smoother smoke with less harshness on the throat

For anyone regularly paying $18–$25 per pre-roll in premium-priced markets, investing in the right accessories often makes more financial sense than constantly chasing top-shelf products. It’s a practical workaround until market maturity eventually brings those prices down.

Why Prices Vary: The Pre-Roll Pricing Cycle

Phase 1 — New Market Launch (Years 1–2)

-

-

-

- Limited licenses = limited supply

-

-

-

-

-

- High demand outpaces production

-

-

-

-

-

- Prices peak: $20–$30+ per pre-roll

-

-

-

-

-

- Current examples: New York, Ohio, Minnesota

-

-

Phase 2 — Market Expansion (Years 2–4)

-

-

-

- More cultivators and processors licensed

-

-

-

-

-

- Competition increases, quality improves

-

-

-

-

-

- Prices moderate: $12–$18 per pre-roll

-

-

-

-

-

- Current examples: Missouri, Maryland, New Jersey

-

-

Phase 3 — Market Maturity (Years 5+)

-

-

-

- Oversupply becomes common

-

-

-

-

-

- Aggressive price competition

-

-

-

-

-

- Prices stabilize: $5–$12 per pre-roll

-

-

-

-

-

- Current examples: Oregon, Washington, Michigan, Colorado

-

-

What This Means for You

-

-

-

- In a new market? Expect high prices now, but they WILL drop within 2-3 years.

-

-

-

-

-

- Near a mature market? Consider a day trip for significant savings.

-

-

-

-

-

- Patient consumers win — wait 6-12 months after a market opens for better prices.

-

-

5 Ways to Save Money on Pre-Rolls

1. Shop Daily Deals and Happy Hours

Most dispensaries offer rotating specials. Common patterns:

-

-

-

- “Pre-Roll Fridays” — discounted joints end of week

-

-

-

-

-

- 4:00–7:00 PM happy hours — 10-20% off

-

-

-

-

-

- First-time customer discounts — often 15-25% off entire order

-

-

2. Buy Multi-Packs Instead of Singles

Price per joint drops significantly in bundles:

-

-

-

- Single 1g pre-roll: $12

-

-

-

-

-

- 5-pack of 0.5g pre-rolls (2.5g total): $25 ($5/joint equivalent)

-

-

-

-

-

- 10-pack minis: Often best value per gram

-

-

3. Join Loyalty Programs

Free to join, real savings over time:

-

-

-

- Points per dollar spent (typically 1-5%)

-

-

-

-

-

- Birthday discounts

-

-

-

-

-

- Member-only flash sales

-

-

-

-

-

- Early access to new products

-

-

4. Compare Prices Online First

Never walk into a dispensary blind:

-

-

-

- Weedmaps — browse menus, filter by price

-

-

-

-

-

- Leafly — compare across multiple dispensaries

-

-

-

-

-

- Dutchie — many dispensaries post full menus with pricing

-

-

-

-

-

- Jane — real-time inventory and pricing

-

-

Medical vs. Recreational Pricing

Key Differences:

| Factor | Medical | Recreational |

|---|---|---|

| Taxes | Lower (often 50-75% less) | Full state + local taxes |

| Typical Savings | 15-25% cheaper | Standard pricing |

| Access | Requires medical card | 21+ with valid ID |

Is a Medical Card Worth It?

-

-

-

- Yes if: You buy frequently (weekly+), your state has high rec taxes, you want access to higher potency products

-

-

-

-

-

- Maybe not if: You buy occasionally, rec taxes are low in your state, you don’t want to deal with card renewal

-

-

Frequently Asked Questions

What is the average cost of a pre-roll in 2026?

Nationally, the average pre-roll costs $6–$15 for a standard 1-gram joint. Infused pre-rolls average $15–$25. Prices vary significantly by state, with Oregon and Washington at the low end ($5–$8) and New York at the high end ($20–$30).

Why are pre-rolls so expensive in some states?

Three main factors drive high prices:

-

-

-

- New markets — limited supply can’t meet demand

-

-

-

-

-

- High taxes — some states charge 25-45% total cannabis tax

-

-

-

-

-

- Few licenses — limited competition keeps prices inflated

-

-

Are infused pre-rolls worth the extra money?

Infused pre-rolls cost 50-100% more but contain added concentrates (kief, hash, diamonds, or distillate) that significantly increase potency. Worth it if: you have high tolerance, want stronger effects, or are sharing with a group. Skip if: you’re new to cannabis or prefer milder experiences.

How many joints come in a pre-roll pack?

Common pack sizes:

-

-

-

- Singles — 1 pre-roll (most common)

-

-

-

-

-

- 2-packs — often 0.5g each (1g total)

-

-

-

-

-

- 5-packs — usually 0.5g each (2.5g total) or 1g each (5g total)

-

-

-

-

-

- 10-packs — typically mini/dogwalker sizes (0.3-0.5g each)

-

-

Will pre-roll prices keep dropping?

Generally, yes. As markets mature and competition increases, prices typically fall 30-50% over 3-5 years. However, premium/infused segments may hold value as brands differentiate on quality rather than price.

Is it cheaper to roll my own joints?

Usually, yes. Buying flower and rolling yourself can save 30-50%:

-

-

-

- 3.5g flower ($25–$40) = 3–7 joints

-

-

-

-

-

- Rolling papers/cones = $0.10–$0.50 each

-

-

-

-

-

- Total cost per joint: $4–$8 vs. $8–$15 for pre-rolls

-

-

Trade-off: Convenience, consistency, and no learning curve make pre-rolls worth the premium for many consumers.

Methodology & Data Sources

Data Sources:

-

-

-

- Headset Analytics — point-of-sale data from 3,500+ retailers across 12 tracked U.S. markets

-

-

-

-

-

- State cannabis control boards — official pricing reports where available

-

-

-

-

-

- Dispensary menu aggregators — Weedmaps, Leafly, Dutchie, Jane

-

-

-

-

-

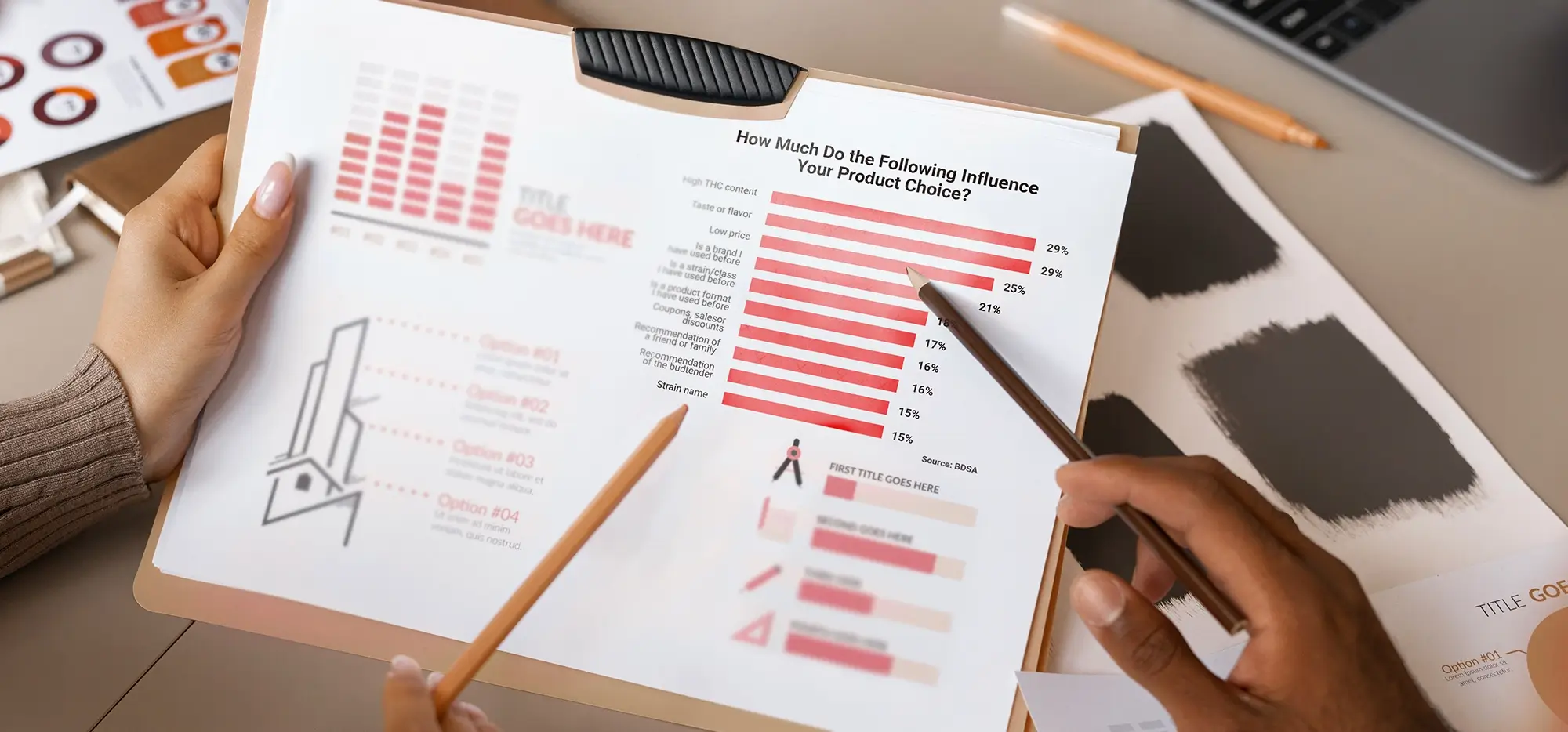

- Industry reports — BDSA, New Frontier Data, MJBizDaily

-

-

Important Notes:

-

-

-

- Prices reflect averages — individual dispensary prices vary significantly

-

-

-

-

-

- Data represents legal, licensed dispensaries only

-

-

-

-

-

- Prices exclude hemp-derived products (THC-A, delta-8, etc.)

-

-

-

-

-

- Markets change rapidly — we update this guide quarterly

-

-

Data Limitations:

-

-

-

- Some newer states (OH, MN) have limited data availability

-

-

-

-

-

- Rural vs. metro pricing gaps are estimated based on available reports

-

-

-

-

-

- Infused pre-roll category includes wide variety of product types

-

-

Conclusion

Pre-roll prices in 2026 range from under $5 in mature markets like Oregon and Michigan to $25+ in emerging markets like New York. The biggest factors affecting what you’ll pay are your state’s market maturity and whether you choose standard or infused products. Use our state-by-state guide to set expectations, then compare prices on Weedmaps or Leafly before your next dispensary visit.

-1.webp)

-1.webp)

-2.webp)