Trends in the European Cannabis Vape Market: What Are European Cannabis Consumers Looking for?

Cannabis Legalization Trends in Europe

Recently, the German Coalition Government officially announced the effective date of the long-awaited cannabis legalization bill. The bill, which legalizes the possession and cultivation of cannabis, will go into effect on April 1, 2024, making Germany the second country in Europe to legalize recreational cannabis after Malta. According to the latest 2023 Cannabis Vape Industry White Paper published by Artrix, Europe is the second largest consumer market for cannabis worldwide, after North America. Medical cannabis has already been legalized in several major countries and regions in Europe, while legislation for recreational cannabis is currently underway in some countries. Overall, there is a positive trend in public acceptance of the decriminalization of recreational cannabis in Europe, and the government policies in some European areas and countries regarding cannabis are gradually becoming more lenient.

It is anticipated that Europe has a significant potential to become the next thriving market for cannabis vaporization products. Currently, European users mainly consume cannabis products in the form of flowers, with vaporizers primarily used for vaporizing cannabis flowers. While there are some vaporizer devices available for cannabis oil products, they are relatively scarce, indicating a vast potential for market development of vaporization products. In a 2021 interview with Forbes, the CEO of Curaleaf International Ltd. expressed optimism about the future of the cannabis industry in Europe. With reasonable regulatory reforms in the respective countries, cannabis vaping products are expected to become one of the main cannabis product categories consumed by European cannabis users.

The Popularity Trend of Cannabis HHC Vape in Europe

In the rapidly growing Europe cannabis vape market, a popular and eye-catching product category has emerged – HHC vape. Since its introduction to the European cannabis market in May 2022, the HHC cannabis vape have gradually gained popularity as a legal alternative to Delta-9 cannabis products and are openly sold in many regions of Europe. According to Google Trends data, HHC vape has gained significant attention in Europe and has a large potential user base. Since 2021, there has been a noticeable increase in user interest in HHC vaping products, and this interest is expected to escalate further in 2024.

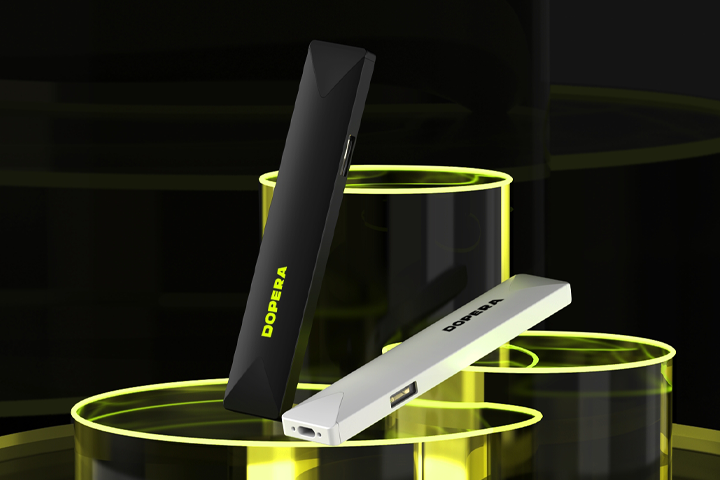

Influenced by the widespread popularity of disposable nicotine e-cigarettes in the market, European HHC users have a higher preference for disposable vape products than Delta-9 vape users, especially cylindrical and flat-shaped disposable cannabis vaporizers. A survey on popular HHC brands in Italy revealed that Cartuccia, Eighty8, Canapuff, and Canatropy occupy approximately 60% of the HHC market share in Italy. Among these brands, Eighty8, Canapuff, and Canatropy show a rapid growth trend in popularity. Apart from HHC cannabis flowers and HHC cannabis edibles, the main vaporizer products of these three brands are consistently showing an increasing trend in popularity. Online stores catering to European consumers such as Canatura and Hempolishop mainly promote disposable flat or cylindrical vaporizers as the leading HHC brands in Europe.

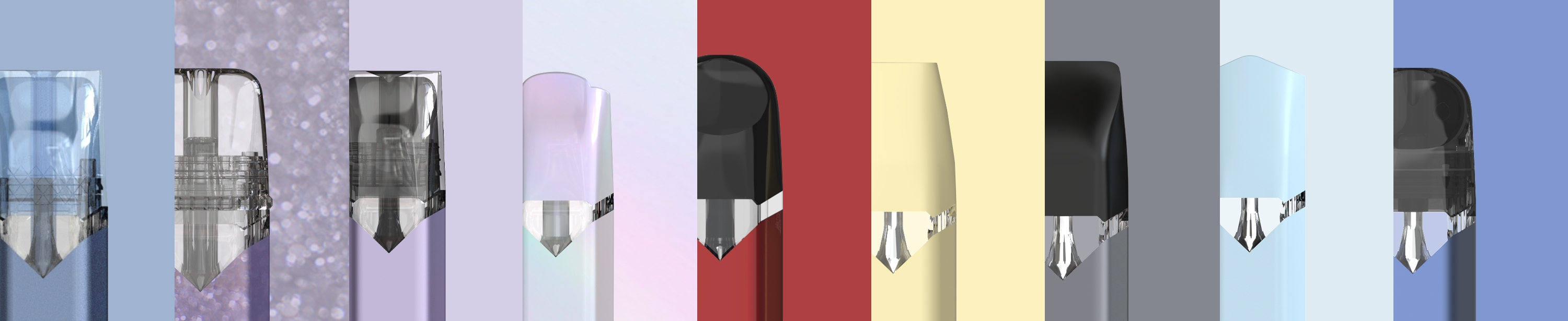

At the consumer level, flat-shaped disposable cannabis products meet the current consumption demands of European consumers. In the UK market, as reported by North Norfolk News, the top four best-selling disposable brands all offer flat-shaped disposable products. The popular product information on the shopping website Flawless CBD UK also confirms the high popularity of flat-shaped disposables in the UK. Since recreational cannabis products are still not legalized in the UK, many consumers still prefer a discreet option during use. The flat-shaped disposable cannabis vaporizer is similar to a nicotine e-cigarette and provides a discreet choice for consumers. Similarly, in other parts of Europe, HHC vaping falls into a grey area with no legal regulations, and consumers are often looking for a portable and discreet vaporizer to meet their daily needs.

Pain Points in the European Cannabis Vape Market

Pain Point 1: Lack of Reliable High-Quality Products

The disposable HHC vaporizer market in Europe is experiencing significant growth, leading to an increase in the number of brands available. However, there are currently no major players in the European market, creating a great opportunity for many cannabis brands to enter the European cannabis market. Despite the thriving market for HHC vaporizers in Europe, consumers still face certain pain points. Some European consumers have provided feedback regarding design issues with many disposable flat-shaped vapes. These vapes require a significant amount of suction force to function properly and often experience airflow blockages, resulting in a sub-par vaping experience.

Furthermore, some disposable vapes do not have a charging port, making them unusable if there is leftover cannabis oil that hasn’t been consumed. Additionally, some products have battery problems that frequently lead to charging or usability issues. These substandard hardware devices have a significant impact on the vaping experience for cannabis vape users. While consumers are interested in trying cannabis vaping products, they struggle to find high-quality options on the market.

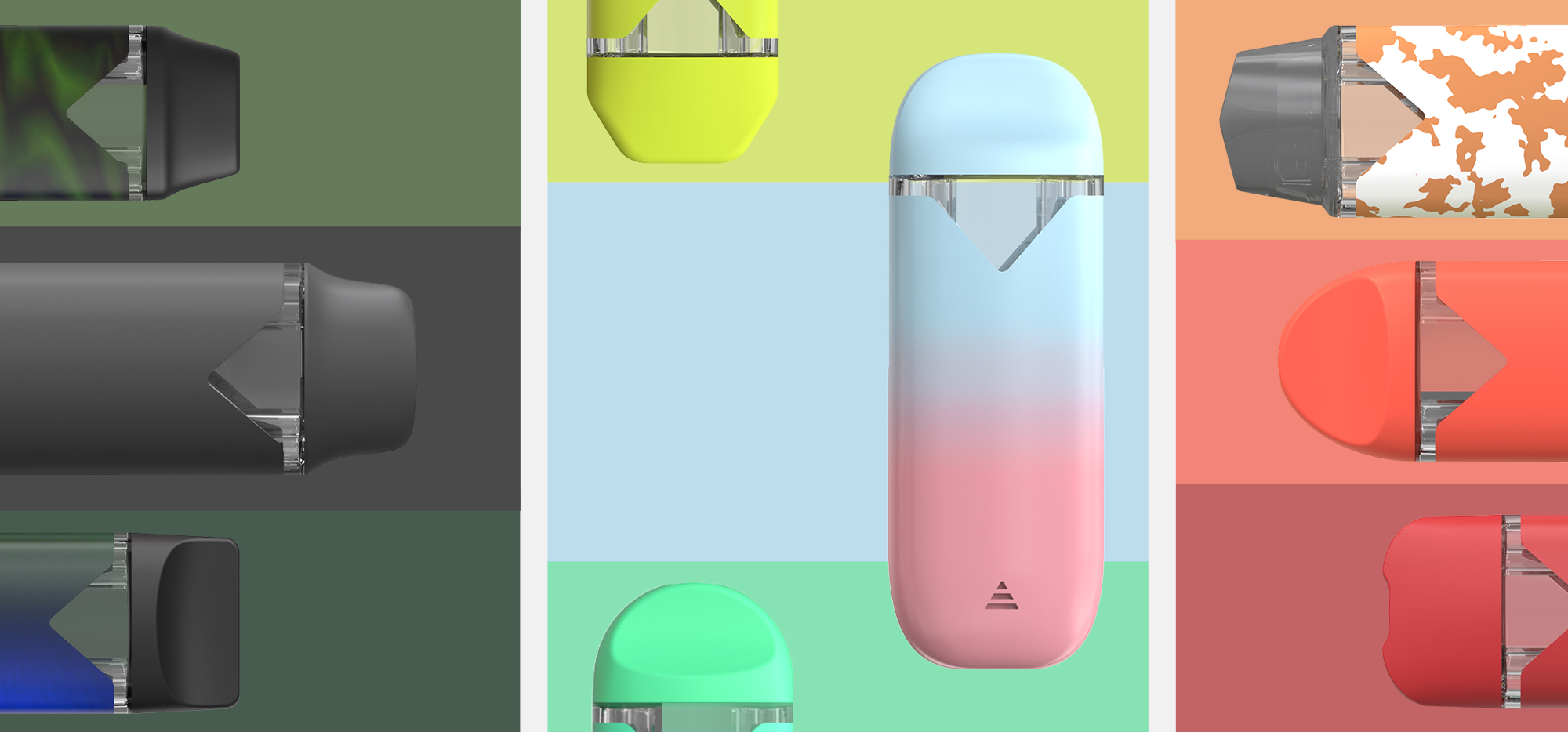

To address this issue and ensure a better consumer experience, Artrix has introduced the “Product Quality Standard System.” This system comprehensively standardizes the manufacturing standards of cannabis vaporizers through 4 product aspects and 13 detailed standards. It serves as a pioneering demonstration in the cannabis vaporizer manufacturing industry. Artrix’s recently launched flat-shaped disposable vaporizer, Sip, features a dual airflow design structure that effectively solves and prevents common issues of cannabis oil airflow blockage. With its minimalist and functional design, consumers can start vaping as soon as they receive the product, providing them with the most straightforward consumption experience.

Pain Point 2: High Product Homogeneity

European cannabis users appreciate the convenience and discretion of cannabis vaping products. In Europe, the use of cannabis vaping products has been decriminalized in accordance with the policies of several countries and regions. However, the legal status of HHC vaping remains uncertain and falls into a grey area. Many consumers prefer to keep their cannabis use private. According to the European Drug Report 2023, approximately 15.1% (15.3 million) of the population aged 15-34 years in Europe used cannabis in 2022.

A significant proportion of cannabis users in this age group are either students or in the early stages of their careers. They tend to have lower incomes, but value socialization and stress relief. Disposable cannabis vapes, which are affordable on a per-unit basis, are particularly popular with this consumer group. Sip can be enjoyed in a variety of settings and its elegant design makes it suitable for consumers of all genders and ages. In addition, Sip’s appearance is very similar to that of traditional flat nicotine vapes. Its minimalist design, ease of use, excellent portability and ability to be discreetly concealed in the hand make it an ideal choice for mainstream disposable cannabis vaping consumers in Europe.

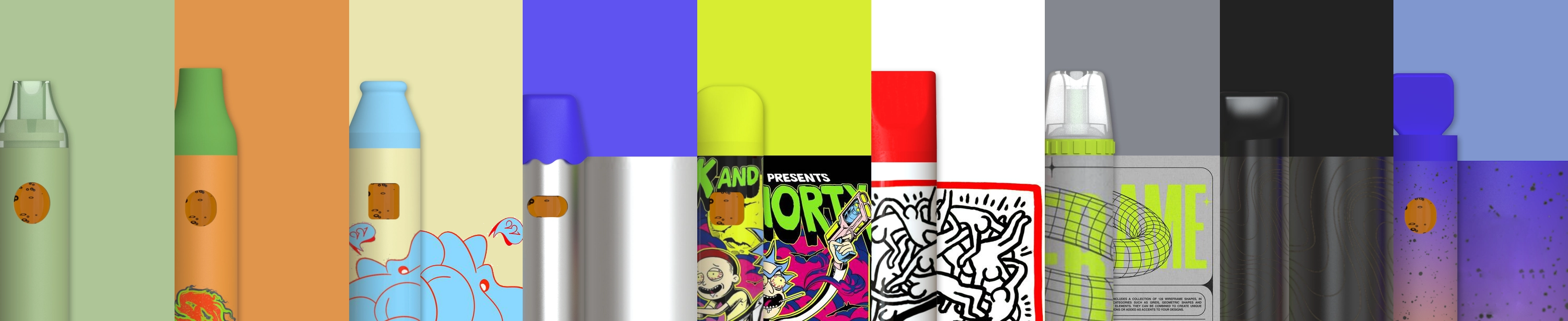

Another challenge in the European disposable cannabis vaporizer market is the limited variety of products. According to the European Drug Report 2023, approximately 2.1% (2.1 million people) of cannabis users in Europe smoke cannabis daily or almost every day. The majority of these users (75%) are male and mostly under the age of 35. This demographic consists mainly of individuals from the Generation Z cohort, who value multiculturalism and seek personalized cannabis vaporizers.

However, the current disposable flat-shaped vaporizers available in the European market lack diversity in appearance design. These products are essential accessories for many cannabis vaporizer users, but they do not cater to the individual preferences of the main user group through differentiation. To solve this problem, Artrix has introduced the 1+9 Programme. Using the Sip disposable flat-shaped vaporizer as an example, Artrix offers exclusive product services that include appearance design, material selection, and custom logos. This program aims to meet the personalized needs of a wider range of consumers while maintaining the product’s elegant and minimalist characteristics.

Disposable flat-shaped vapes have gained popularity in North America and show potential in the cannabis vaporization market. With the legalization of recreational and medical cannabis in Europe, there is an untapped market for these products. Due to their discreet nature and affordable price, disposable flat-shaped vapes could thrive in Europe. The UK, influenced by disposable e-cigarettes, could also be a significant market. Practitioners in the cannabis vaporization industry should consider these products for potential opportunities.

Artrix is Here to Support Europe Cannabis Vape Business

The European cannabis market presents promising opportunities for future development, but it can be challenging to navigate for ambitious cannabis vape companies. Cannabis companies require comprehensive support services to facilitate their business growth. Artrix distinguishes itself from other conventional cannabis vape hardware manufacturers, by not only providing premium hardware products but also by offering custom-tailored marketing support and strategy consultation to help clients achieve maximum success.

Upon purchasing Sip products from Artrix, clients will receive market information, marketing advice, and market promotion services for disposable flat-shaped vapes in various regions. For example, Artrix can provide marketing visual materials with brand style and market trends for the product in cannabis vape dispensaries. To enhance the professionalism and efficiency of product marketing and promotion, Artrix also delivers personalized digital marketing services tailored to target users in line with digital media marketing trends on popular social media platforms such as LinkedIn, X, Instagram, etc.

Further Reading

-1.webp)

-1.webp)

-2.webp)